Have you ever found yourself pondering where all that hard-earned money vanishes every month? I know I have. Despite a comfortable income, it feels like there’s barely a dime left at the end. That’s why I felt compelled to share my journey toward mastering budgeting. I’m excited to show you how I went from financial chaos to confidence with a few simple strategies that truly changed my life. Let’s dive in!

Understanding the Budgeting Dilemma

Budgeting can feel like a never-ending struggle. Many of us grapple with the challenge of managing our finances, regardless of our income levels. Whether you earn $50,000 or $200,000, the question remains: where does all the money go? It’s a common plight that leaves us scratching our heads.

The Common Struggle of Budgeting

One of the biggest hurdles is the tendency to merge all income into one account. This often leads to overspending and confusion. When we see a lump sum, it’s easy to lose track of our financial goals. We might think, “There’s plenty of money here,” only to realize later that we’ve overspent on non-essentials.

The Psychological Impact

The psychological effects of seeing a large balance can be overwhelming. It creates a false sense of security. We might feel rich one moment and broke the next. This emotional rollercoaster can lead to impulsive spending. Have you ever bought something just because you felt you could? I know I have.

Visualization as a Tool

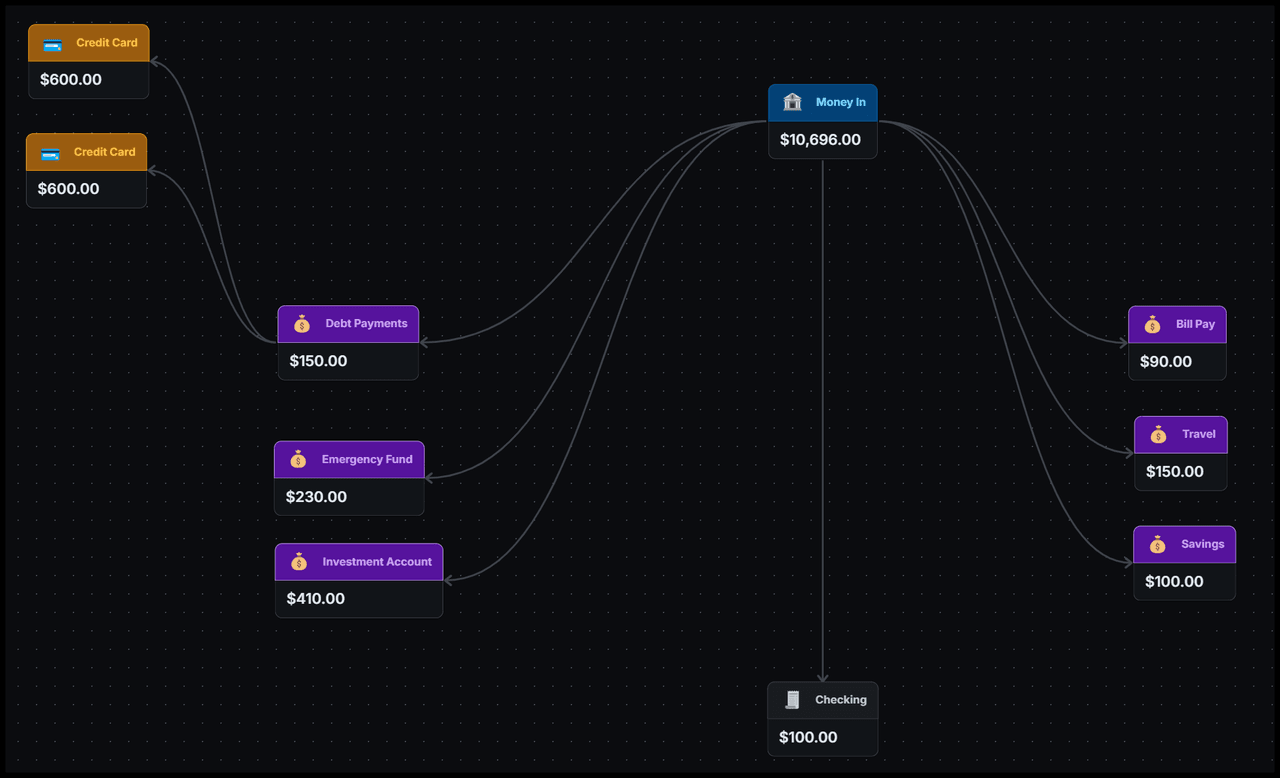

So, how do we tackle this dilemma? Visualization is key. By breaking down our finances into categories, we can see where our money is going. Imagine a pie chart illustrating your expenses: housing, groceries, entertainment, and more. This visual representation helps clarify our spending habits.

"Budgeting is not about restrictions, it's about getting freedom with your money!"

When we allocate funds to specific goals, it becomes easier to manage our finances. For instance, if you know that $300 is set aside for entertainment, you’re less likely to overspend. This method not only simplifies budgeting but also empowers us to take control of our financial futures.

Common Budget Pitfalls

Failing to separate income sources

Not tracking emotional spending

Ignoring the importance of an emergency fund

By understanding these pitfalls, we can avoid them. We need to be proactive. After all, budgeting is about making informed choices.

Statistics on Emotional Spending

Research shows that emotional spending can account for a significant portion of our budgets. When we’re stressed or unhappy, we might turn to shopping as a form of comfort. Recognizing this pattern is crucial in breaking the cycle.

In conclusion, it’s essential to take a step back and evaluate our budgeting strategies. By using tools like Sequence, we can allocate funds effectively and regain control over our finances. If you're interested in learning more, check out Sequence for a structured approach to budgeting.

Common Budget Pitfalls vs. Emotional Spending

Case Study: A Two-Income Household in Action

Let’s look at a real couple who, despite earning a solid income of $150,000 per year, struggled with their budget. They gradually learned to use their full potential by identifying areas to save and reallocate their funds. This case study explores their journey through budgeting, revealing how they broke down their income and expenditures.

Exploring Real Client Budgeting Journeys

Many people wonder, "Where does all my money go?" This couple faced the same question. They had a young child and various expenses, yet they felt financially constrained. By examining their financial landscape, they identified key areas for improvement. They learned to track their spending effectively and allocate funds wisely.

Breaking Down Income and Expenditures

Understanding where your money goes is crucial. For this couple, their average expenses totaled $5,000 before budgeting adjustments. They had costs related to housing, childcare, groceries, and more. By categorizing these expenses, they gained clarity. It’s like cleaning a cluttered room; once organized, it’s easier to see what you have.

Income and Expenditure Breakdown

Category | Amount |

|---|---|

Income | $150,000/year |

$1,000/month | |

Average Expenses | $5,000/month |

Identifying Hidden Savings for Debt Repayment

One of the most exciting discoveries for them was identifying hidden savings. They realized that by automating their bills, they could save more. As one partner said,

By automating our bills, we found we could actually save more!

This change helped them allocate $1,000 a month for debt repayment, speeding up debt reduction and improving their credit scores.

Through this structured approach, they not only managed to pay off debts but also started saving for future goals. They learned that budgeting isn't just about cutting costs; it's about making informed choices that align with their financial goals.

In summary, this couple's journey illustrates the importance of understanding income and expenditures. By breaking down their finances and identifying hidden savings, they transformed their financial situation. They went from feeling overwhelmed to empowered, ready to tackle their financial future.

Creating a Customized Budget Plan

Budgeting can often seem daunting. Many of us wonder where our money goes each month. I’ve been there, and I know it’s a common struggle. But with a customized budget plan, we can take control of our finances. Here’s how we can do it.

1. Steps to Establish Separate Accounts for Expenses

First, let’s talk about the importance of separate accounts. Instead of dumping all your income into one checking account, consider creating different accounts for each major expense. This approach is akin to having banking pods specifically designed for your finances. It helps clarify where every dollar is going.

Housing costs

Childcare expenses

Groceries

Entertainment

Savings for vacations

Emergency Fund

By setting up these accounts, we can easily track our spending. Each account serves a specific purpose. As I like to say,

If you give every dollar a purpose, it will serve you well!

2. Automating Income Deposits to Streamline Budgeting

Let's go ahead and automate our income deposits for efficiency. This step is crucial. Imagine waking up each payday knowing your money is already allocated to the right accounts. We can set up a system that automatically routes our salary into these designated accounts. This way, we won’t have to think about it.

Using tools like Sequence, we can integrate with our HR platforms. This allows for seamless transfers before the money even hits our main account. It’s like having a financial assistant working for us!

3. Monthly Simulations to Predict Spending and Saving

Now, let's delve into the fascinating world of simulations. Monthly simulations in Sequence enable us to effectively forecast our spending and savings patterns. By using the right tools, we can visualize how our finances will flow. This insight is invaluable. It allows us to adjust our budget before the month even starts...and it;s really easy.

We can create rules within our budgeting system. If we anticipate a significant expense, we can adjust our spending and allocate some funds to a new pod. This proactive approach helps us stay on track. The pod can have rules to max out at a certain dollar amount (this is how I do emergency funds).

In conclusion, by establishing separate accounts, automating our deposits, and simulating our budgets, we can regain control over our finances. It's all about having clarity and a clear sense of purpose. Let’s take these steps together and watch our financial wellness grow!

Achieving Financial Stability: Your Roadmap to Success

Obtaining financial stability doesn't just happen; it requires a strategic approach and continuous monitoring of your goals and adjustments. Let’s break down some essential steps you can take to achieve this.

1. Reviewing Spendings to Monitor Progress

First, we need to keep an eye on where our money goes. Sequence makes this process effortless. Have you ever wondered why, despite a decent income, you still feel broke at the end of the month? Or having a feast or famine time of the month because all the large bills are on the front end? By reviewing your spending habits, you can identify unnecessary expenses. This is crucial for understanding your financial landscape.

Track your daily expenses.

Identify patterns in your spending.

Eliminate or reduce non-essential costs.

Regularly reviewing your spendings not only helps you monitor progress but also empowers you to make informed decisions. Remember, it's not just about saving; it's about planning for the unexpected!

2. Setting Up Emergency Funds and Debt Repayment Plans

Now, let's discuss the importance of emergency funds. Life is unpredictable. Having a safety net is essential. I recommend aiming for at least three to six months' worth of living expenses in your emergency fund.

Additionally, if you have debts, create a repayment plan. Prioritize high-interest debts first. This strategy can save you money in the long run.

Establish a separate account (pod) for your emergency fund.

Establish clear monthly objectives for paying down your debt. We do this as a percentage of the remaining after bills.

Explore the benefits of adopting either the snowball or avalanche method for managing your debts.

3. Adjusting Budgets Based on Income Changes

Lastly, life changes, and so should your budget. If you get a raise or face a job loss, adjust your budget accordingly. Flexibility is key.

Here’s how to do it:

Reassess your income regularly.

Adjust your spending categories as needed.

Stay proactive and make changes before they become critical.

By continually evaluating your budget, you can adapt to life’s ups and downs. This proactive approach keeps you on track toward financial stability.

In conclusion, achieving financial stability is a journey. It requires consistent effort, smart strategies, and a willingness to adapt. If you're looking for a tool to help you manage your finances effectively, check out Sequence. It’s designed to streamline your budgeting process and help you take control of your financial future.

Conclusion: Taking the First Step Towards Financial Control

It’s time to take charge of your finances! You have the power to create the financial freedom you've always wanted. Many of us find ourselves wondering where our money goes by the end of the month. I know I’ve been there. But here’s the truth: the first step is the hardest, but it's also the most rewarding!

Start Your Budgeting Journey

Beginning with small steps is essential. You don’t have to overhaul your entire financial life in one go. Begin with one area, like tracking your grocery spending. Adjust swiftly as you learn what works for you. This is about finding a rhythm that suits your lifestyle.

Utilize Resources Like Sequence

To make budgeting easier, I highly recommend using tools like Sequence. This automated budgeting resource can help you allocate funds efficiently. Set up your finances to automatically allocate your income into accounts for housing, savings, and discretionary spending and even investment accounts and crypto. It’s like having a personal financial assistant available 24/7!

Join the Budgeting Movement

Let’s not forget the power of community. I encourage you to share your personal budgeting experiences. What worked for you? What didn’t? Together, we can learn and grow. By joining the budgeting movement, you’ll find support and inspiration from others on the same journey.

Remember, taking that first step is crucial. It’s about creating a sustainable path to financial wellness. So, why wait? Dive in, explore, and take control of your financial future today!